Acadia SVA Margin Call Contracts

Acadia MarginSphere supports Sole Calculation Valuation Agent margin events between counterparties using the Margin API Expected Margin Call xsd with notification flag.

When a Notification is sent via MarginSphere, the counterparty can automatically create a Margin Call from that notification. An Expected Call will be processed as a notification.

NOTE: This does not affect Margin Calls on the agreement.

1. Configuration

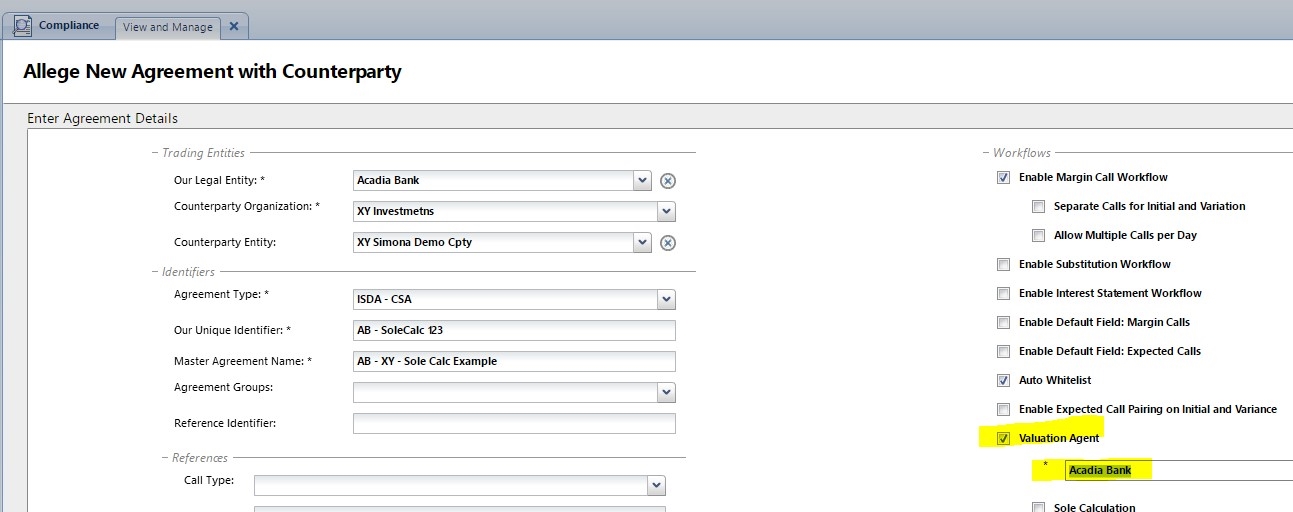

1.1 Agreements in Acadia

In Acadia, there is a Notification field in the agreement. In this field, on e party must be defined as the Sole Calculation Agent on agreements where notifications will be used. The party sending the Notifications is considered to be the Sole Calculation Agent.

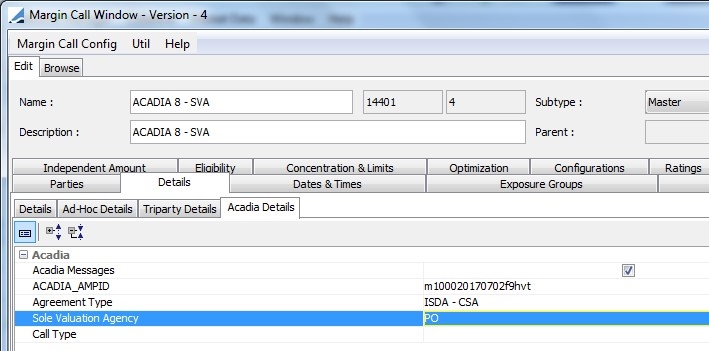

1.2 Margin Call Contracts In Calypso

The Sole Valuation Agency designation is found in the Details > Acadia Details panel of the contract.

The Sole Valuation Agency field has the options of PO or none. If PO is selected, a notification is automatically sent to the counterparty if the Global Required Margin is less than 0.

2. Acadia SVA Workflow

For details on the SVA workflow, see Acadia Configuration SVA Workflow.

For details on the SVA workflow, see Acadia Configuration SVA Workflow.

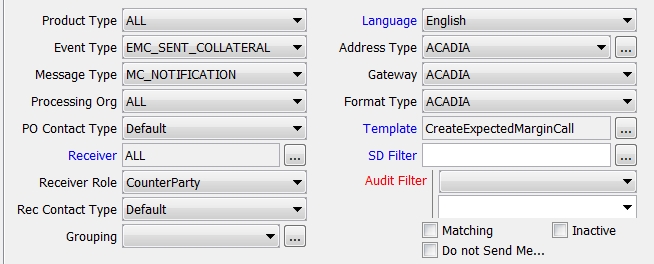

3. Notification

3.1 Message Setup

The fields supplied in the Notification are turned into Margin Call fields by the counterparty. Certain fields are required and signage must be correct.

3.2 Field Details

|

XML Field |

Description |

Notes |

Calypso Column |

|---|---|---|---|

|

marginAgreement AmpId |

Specifies the AmpId of the associated margin agreement. Either AmpId or Agreement Short Name can be provided |

Either Agreement AmpId or Short Name must be provided |

Margin Call Contract > Details > Acadia Details > ACADIA_AMPID |

|

marginAgreement ShortName |

Enter the margin agreement short name. From this value, AMP can derive the Legal Entity, Organization and Counterparty information required to create a new margin call. Either the AmpId or Agreement Short Name can be provided |

Either Agreement AmpId or Short Name must be provided |

Found in the table mrgcall_config, description column. Alternatively, this can be an attribute on the margin call contract |

|

callType |

Specifies the MarginSphere defined type of the margin call. Call type defines weather the call is netted, non-netted or segregated (see buy-side workflows). |

Values: Netted, Initial and Variation |

|

|

valuationDate |

The date on which the asset is valued. Typically this is based on the valuations and prices at the end of the day for the previous business day (T-1). |

|

Table margin_call_entries, trade_datetime column |

|

currency |

The currency of the margin call |

Values: ISO Currency Code |

Table margin_call_entires, contract_currency column |

|

totalCallAmount |

Value of the collateral required to satisfy the margin call |

Absolute value |

Collateral Manager Results panel, Global Required Margin field |

|

exposure |

This is the total collateral requirement amount which is the net of the independent amount plus the mark to market exposure |

from the caller's perspective |

Collateral Manager Results panel, Net Exposure field |

|

collateralValue |

This is the collateral, net of haircut for the collateral already in custody by the party making the call |

from the caller's perspective |

Table margin_call_entries, total_collateral_value column |

|

threshold |

Amount of unsecured exposure a counterparty is prepared to accept before calling for collateral |

Table mrgcall_config, columns po_thres_amt and le_thres_amt |

|

|

deliverAmount |

Specifies the amount to be delivered by the party being called |

Absolute value |

Collateral Manager Results panel, New Margin field |

|

returnAmount |

Specifies the amount to be returned by the party being called |

Absolute value |

Collateral Manager Results panel, Return Margin field |

|

pendingCollateral |

The collateral value, net of haircut, for the collateral that has been pledged but has not settled yet |

from the caller's perspective |

found in Total Collateral field |

|

counterpartyMarkToMarket |

Mark to market value of the trades under the agreement, negation of Variation Exposure |

For the counterparty on the call, these are from the Sole Calculation Agent's perspective |

Collateral Manager Results panel, Net Balance field |

|

counterpartyCollateralBalance |

Collateral value, net of haircut, for the collateral held or posted |

Collateral Manager Results panel, Total Prev Margin |

|

|

counterpartyInitialMargin |

Independent amount required |

Collateral Manager Results panel, IA field |

|

|

notificaiton |

Boolean value that determines whether to make this message an Expected Call or Notificaiton |

true |

|

|

noAction |

If true, indicates that you are not expecting a margin call on the valuation date, and if one is received, it should be disputed |

|

True if GRM > 0 False if GRM < 0 |

3.3 Exposure Direction

Directions are reversed for the following fields:

| • | Exposure |

| • | Total Collateral |

| • | Pending Collateral |

Because it must appear from the caller's (counterparty) perspective , if PO calculates a negative exposure, on the expected margin message it appears as positive.

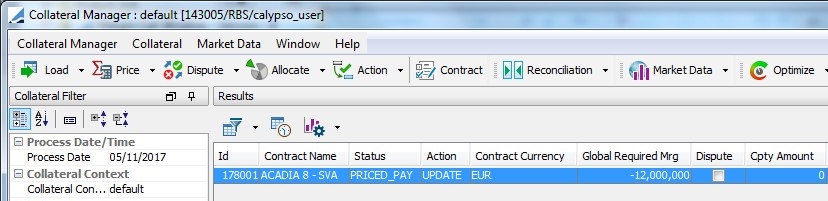

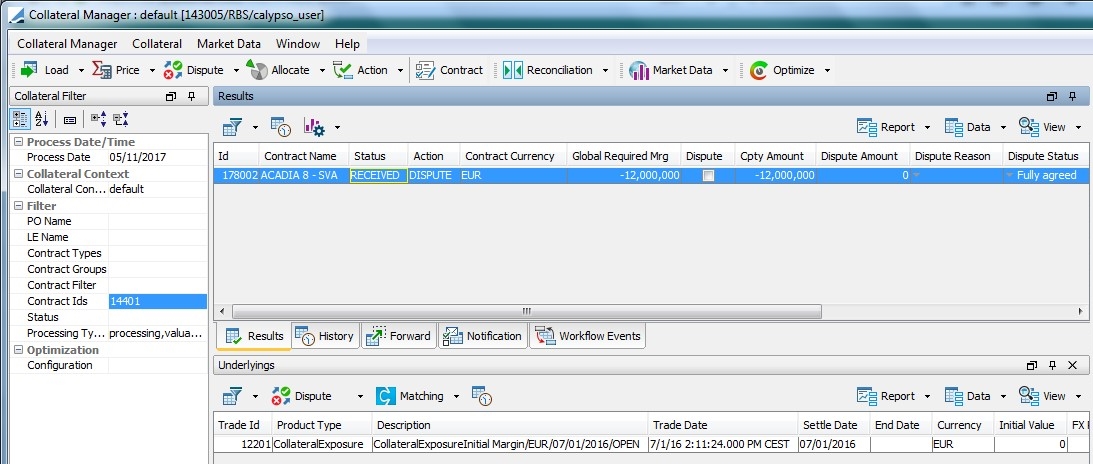

4. Acadia SVA Example

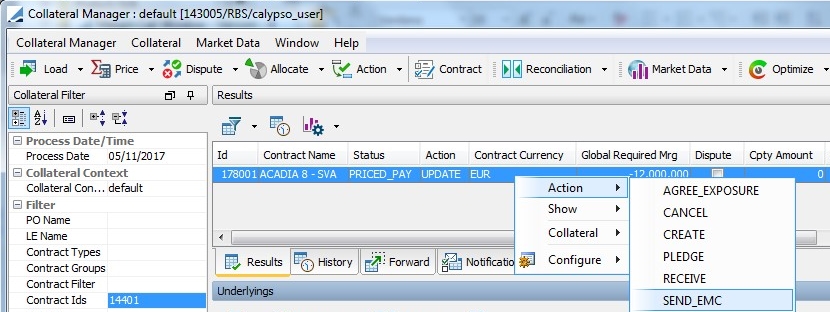

The entry is in PRICED_PAY:

From there, the user would apply SEND_EMC:

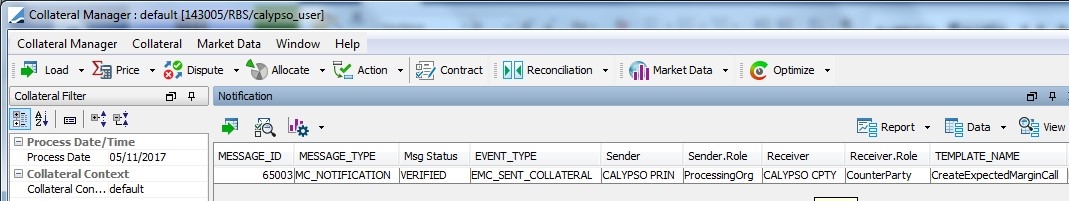

This would generate the following message:

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<amp:expectedMarginCalls xmlns:amp="create.expectedmargincall.api.acadiasoft.com">

<amp:expectedMarginCall>

<amp:collateralValue>0.0</amp:collateralValue>

<amp:currency>EUR</amp:currency>

<amp:deliverAmount>12000000</amp:deliverAmount>

<amp:deliverMinimumTransferAmount>0.0</amp:deliverMinimumTransferAmount>

<amp:deliverRoundingAmount>0.0</amp:deliverRoundingAmount>

<amp:exposure>12000000</amp:exposure>

<amp:initialExposure>0.0</amp:initialExposure>

<amp:minimumTransferAmount>0.0</amp:minimumTransferAmount>

<amp:netRequiredAmount>12000000</amp:netRequiredAmount>

<amp:returnAmount>0.0</amp:returnAmount>

<amp:pendingCollateral>0.0</amp:pendingCollateral>

<amp:returnMinimumTransferAmount>0.0</amp:returnMinimumTransferAmount>

<amp:returnRoundingAmount>0.0</amp:returnRoundingAmount>

<amp:roundingAmount>0.0</amp:roundingAmount>

<amp:threshold>0.0</amp:threshold>

<amp:totalCallAmount>12000000</amp:totalCallAmount>

<amp:callType>Netted</amp:callType>

<amp:valuationDate>

<amp:day>10</amp:day>

<amp:month>5</amp:month>

<amp:year>2017</amp:year>

</amp:valuationDate>

<amp:initialPendingCollateral>0.0</amp:initialPendingCollateral>

<amp:counterpartyMarkToMarket>-12000000</amp:counterpartyMarkToMarket>

<amp:counterpartyCollateralBalance>0.0</amp:counterpartyCollateralBalance>

<amp:counterpartyInitialMargin>0.0</amp:counterpartyInitialMargin>

<amp:notification>true</amp:notification>

<amp:noAction>false</amp:noAction>

<amp:externalReference>178002</amp:externalReference>

<amp:marginAgreementAmpId>m100020170702f9hvt</amp:marginAgreementAmpId>

<amp:marginAgreementType>CSA</amp:marginAgreementType>

<amp:marginAgreementShortName>

</amp:marginAgreementShortName>

</amp:expectedMarginCall>

</amp:expectedMarginCalls>

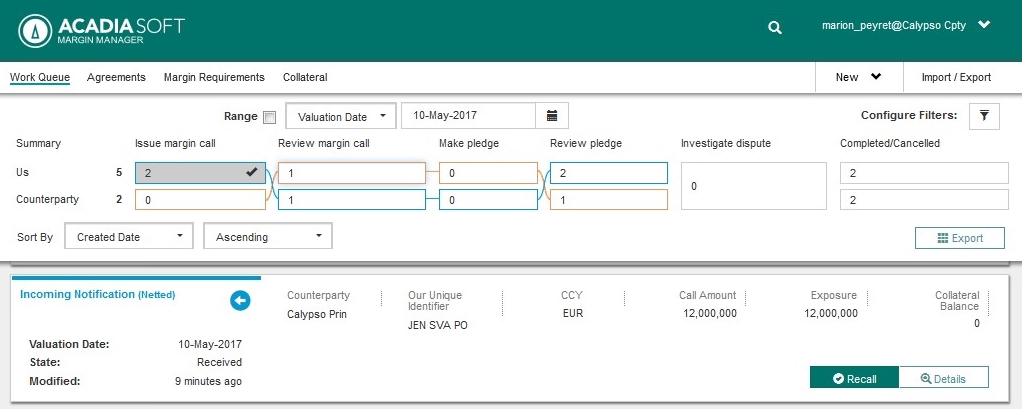

As a result, the following will appear on the Acadia MarginSphere portal:

The counterparty would do a recall:

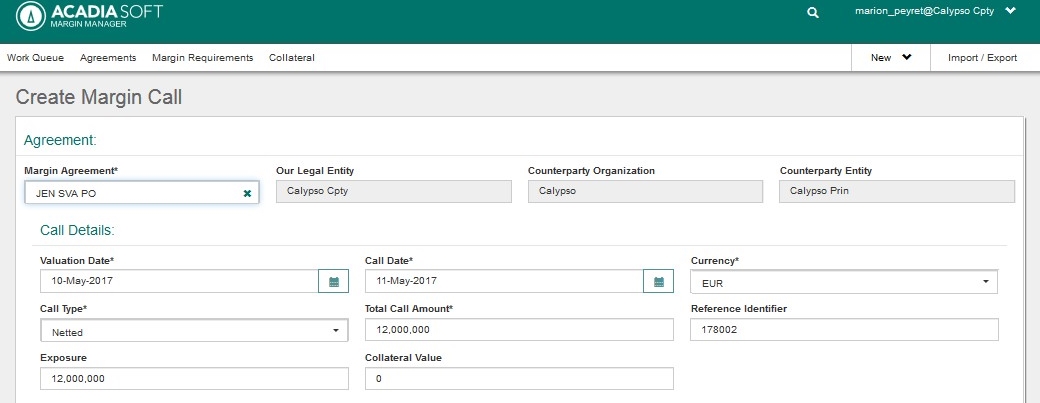

The entry moves to RECEIVED on the Calypso side:

From there, the processing org will pledge and the regular process will apply.