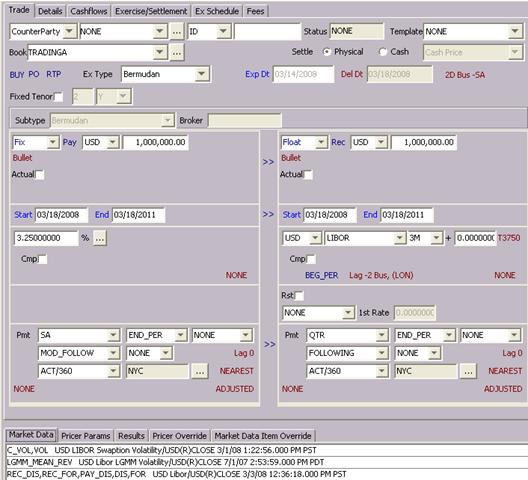

Sample Trade

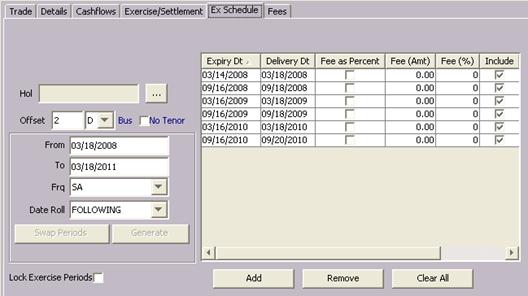

From the Calypso Navigator, navigate to Trade > Interest Rates > Swaption, and enter a Bermudan swaption trade, and generate the Bermudan schedule. The individual European swaptions of the Bermudan schedule will serve as base instruments for the calibration.

It is recommended that the volatility surface associated with the trade has tenors close to the maturities of the individual European swaptions.

If you click Price in the Trade window, PricerCalibratibleLGM uses a default calibration to compute the NPV.

In order to calibrate the LGM model according to user-defined parameters, you need to use the Calibration application described below.