Setting up Freight Commodities

Freight derivatives serve as a means of hedging exposure to freight market risk by providing for the purchase and sale of a freight rate (the "contract rate") along a named voyage route (the "contract route") over a specified period of time (the "contract period"). Contracts are cash settled, there is no physical delivery.

Calypso supports two types of freight products, those traded in Worldscale and Time Charter, traded in USD/Tonne. The setup of both types is described below.

1. Worldscale Freight Setup

Worldscale is a unified system of establishing payment of a freight rate for a given oil tanker's cargo. In negotiating a price to pay, the quotation is referred to as WS100 or 100% of Worldscale.

Freight derivatives, such as Futures and Forward Freight Agreements (FFAs), can be written using WS as a component of the pricing. For example, an FFA could be agreed between two counterparties where one pays a fixed WS rate and settles against a floating WS rate that is observed in the market over a specified time period.

Detailed below is how to configure Worldscale Freight derivatives.

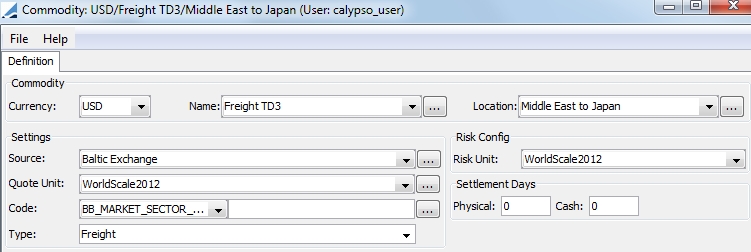

Step 1 - Commodity Configuration

| » | The Commodity Name should be the freight route name. |

| » | The Location is the source to destination point. Locations can be added using the CommodityLocation domain value. |

| » | The quote and risk unit should be a worldscale quote. (Quotes are created in the Commodity Quote Creator.) |

| » | To add the source that publishes the freight rate indices, use the CommoditySource domain value. |

| » | Select Freight as the commodity Type. |

| » | If your Quote and Risk Units are in MTonnes, do not select Freight as Type. |

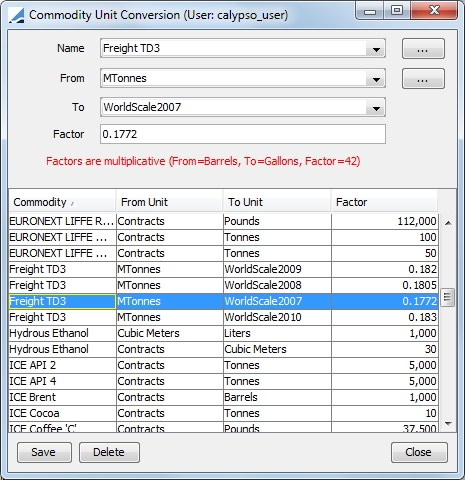

Step 2 - Freight Unit Conversion

In the Commodity Unit Conversion window, you are able to capture the annual Worldscale rates for use in pricing. To view this window from Calypso Navigator, select Configuration > Commodities > Commodity Conversion.

| » | The Name for the unit conversion needs to contain the route designation. |

| » | You may add entries to the To (source) field in the CommoditySource domain value. |

| » | The Worldscale rate contains the year from which is was set. |

| » | Enter the appropriate factor for that route during that year. For example, the rate for TD3 route in 2010 is 18.30, therefore the factor is .1830. |

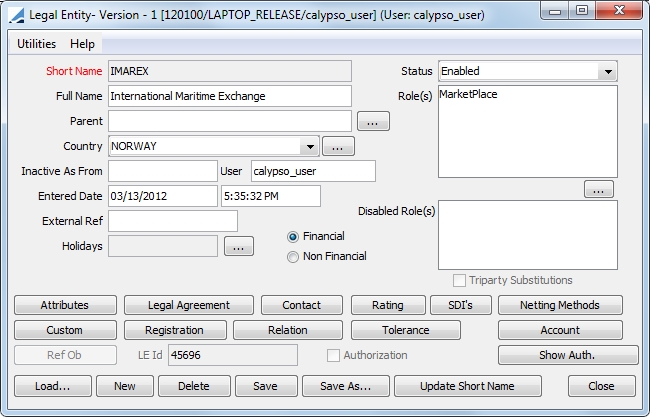

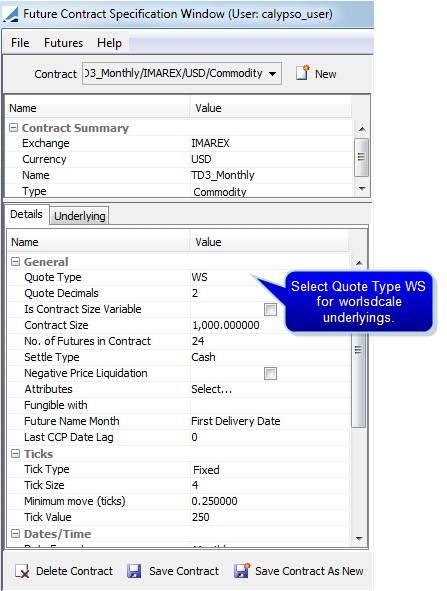

Step 3 - Freight Future Contract Setup

To set up a Freight Future contract, you may need to added the desired exchange and date rule for the exchange. To add and exchange, from Calypso Navigator, select Configuration > Legal Data > Entities. Your desired exchange should be designated as a MarketPlace.

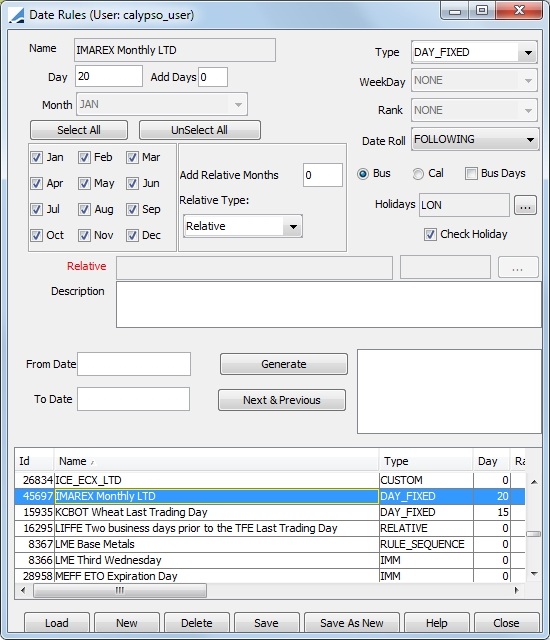

To set up a date rule for the exchange, if necessary, from Calypso Navigator, select Configuration > Definitions > Date Schedule Definitions.

Below is a sample future freight contract.

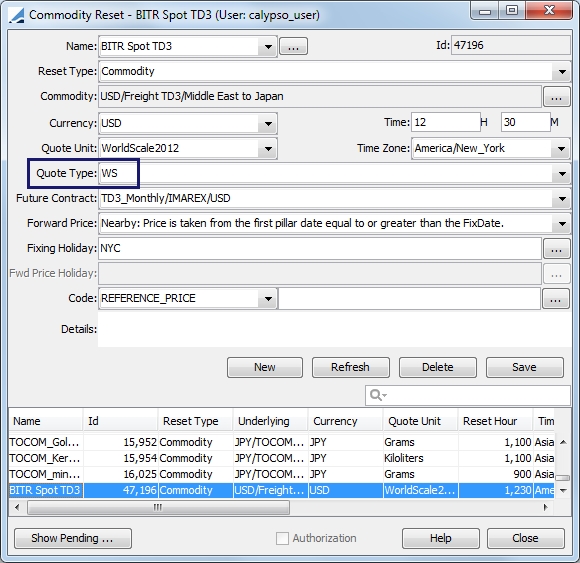

Step 4 - Freight Commodity Reset

The currency and quote unit from the underlying commodity will be the same on the commodity reset. The world scale Quote Type should be WS.

Freight Market Data

There are various market data configurations to accommodate the Freight commodity type. These are summarized below.

Annual Quote

The annual quote is published by the Worldscale Association once per year and is quoted in USD/MTonnes. Rates for the following year are fixed in Q4, therefore it is possible for a route during that period to have two quotes. For this reason, the quote year is embedded in the quote to differentiate.

Establishing the quotes for each year is done using the Quote Creator.

Curve Underlying

The forward curves are defined with Future underliers which can be quoted in USD/MTonnes or WS.

Refer to Freight Future Contract Setup for details on creating a freight future.

Forward Curve

There is no unit conversion supported for freight curves because the underlying commodity is of type Freight. WS quotes are like percentages, which require a fixed rate for each year, by which to multiply the percentage.

Freight Forward curves are most commonly quoted in the reference unit of the route being priced. Therefore, routes quoted in WS will have forward curves in WS and those quoted in USD/MTonnes will have forward curves in USD/MTonnes. There is no unit conversion between WS and USD/MTonnes in the curve generator itself.

For detailed information on setting up a forward curve, refer to Commodity Curves.

Forward Curve Generation

The output of the forward curve follows the unit of the underliers. Underliers in USD/MTonnes have output in USD/MTonnes. Underliers in WS will have their numbers converted to USD/Mtonnes through the swap and future pricers by multiplying the factor from the curve by the annual worldscale rate/100.

For worldscale output, only the Commodity generator can be used and only future underliers with WS quotes are permitted.

2. Time Charter Freight Setup

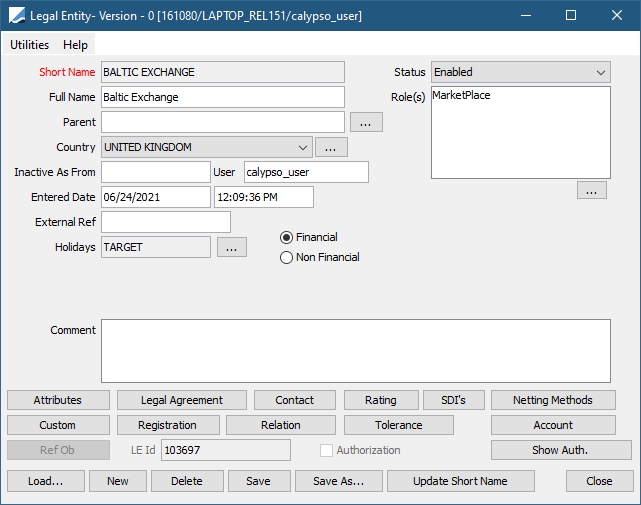

Step 1 - Market Place Setup

Create a Baltic Exchange Market Place in the Legal Entity window. (Configuration > Legal Data > Entities)

Step 2 - Add source in Commodity

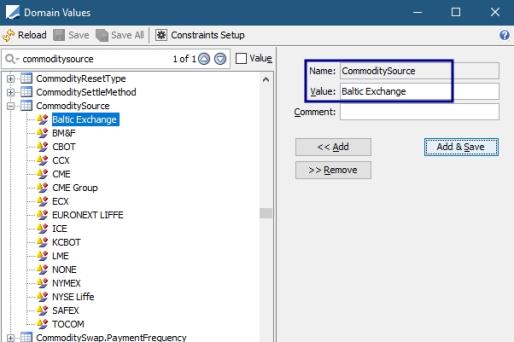

Add the value Baltic Exchange to the CommoditySource domain. (Configuration > System > Domain Values)

The value can also be added directly in the Commodity window by clicking on the ... next to the Source field.

Step 3 - Create commodity FFA C4TC

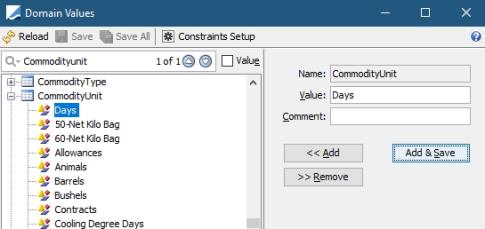

Add the value Days to the CommodityUnit domain. (Configuration > System > Domain Values)

The value can also be added directly in the Commodity window by clicking on the ... next to the Unit field.

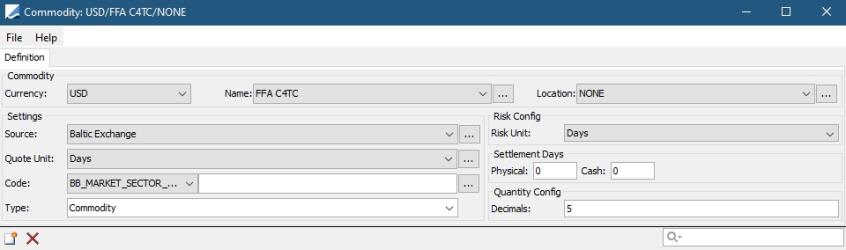

Create a new Commodity for USD/FFA C4TC/NONE. (Configuration > Commodities > Commodities)

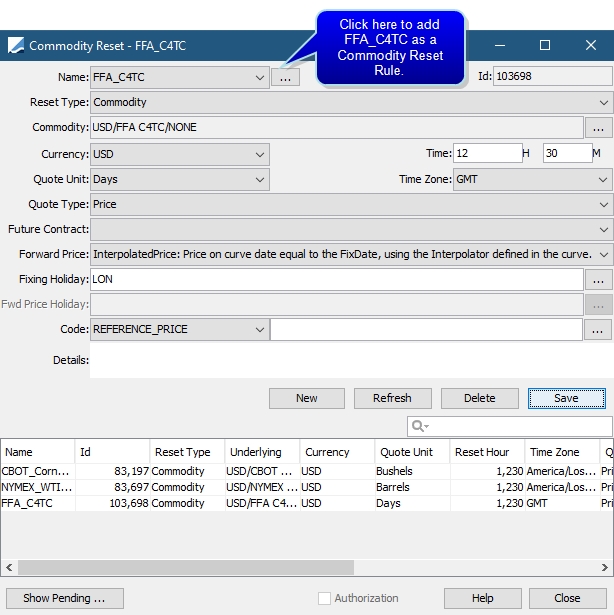

Step 4 - Commodity Reset Rule

Add a new Commodity Reset Rule name by clicking ... next to the Name field. Then create the Reset Rule.

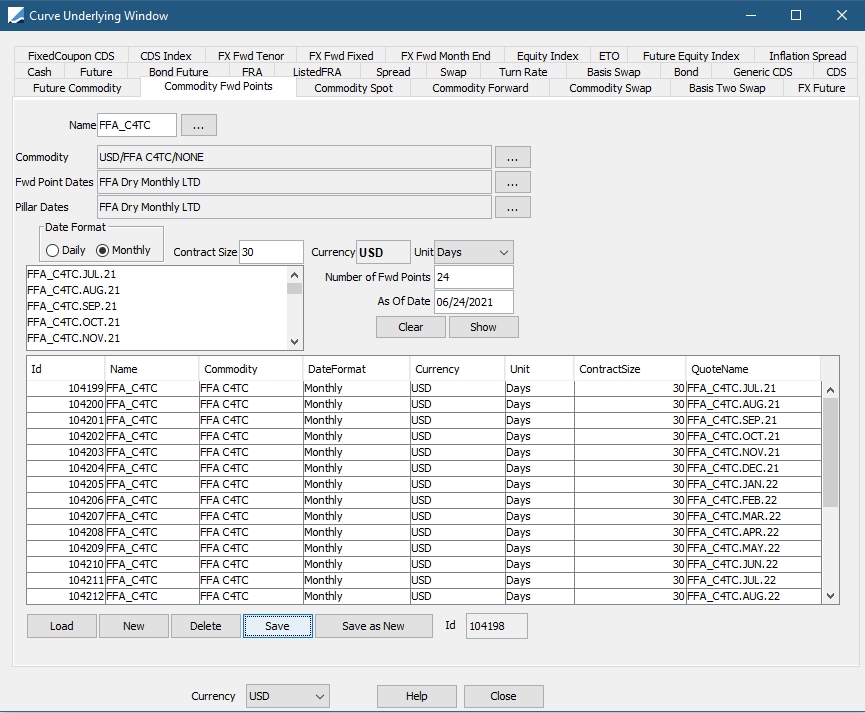

Step 5 - Create Commodity Forward Points

Create the curve underlying for FFA_C4TC. (Configuration > Market Data > Curve Underlyings)

If needed, define a date rule for the curve underlying in the Date Rules window. (Configuration > Date Schedule Definition > Date Rules)

For information regarding curve underlyings, refer to Market Data Curve Commodity documentation.

For information regarding curve underlyings, refer to Market Data Curve Commodity documentation.

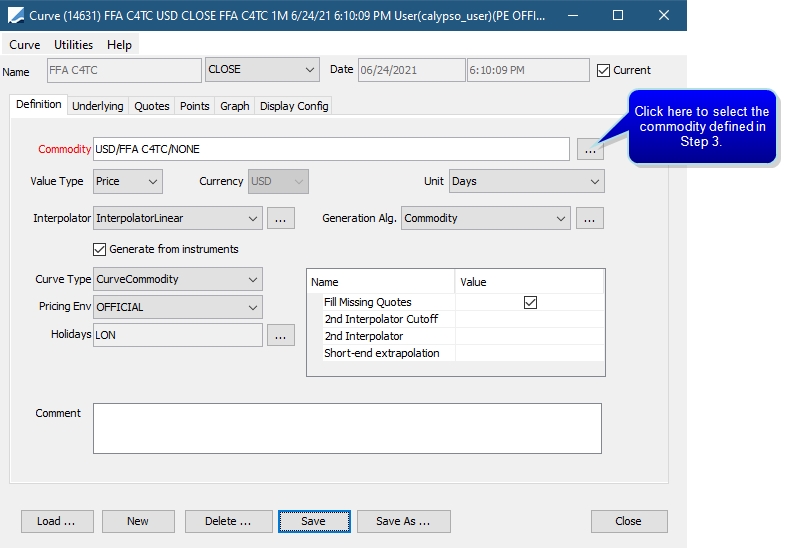

Step 6 - Create a Commodity Forward Curve

Create a commodity forward curve using the curve underlying that was just created. (Market Data > Commodity Curves > Forward Curve)

Definition

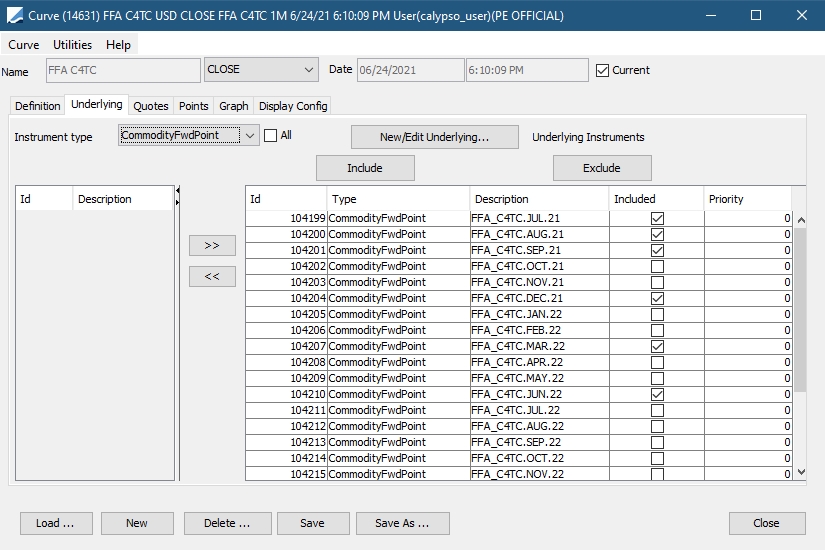

Underlying

Choose at least 3 near month, 3 quarterly and 1 yearly point.

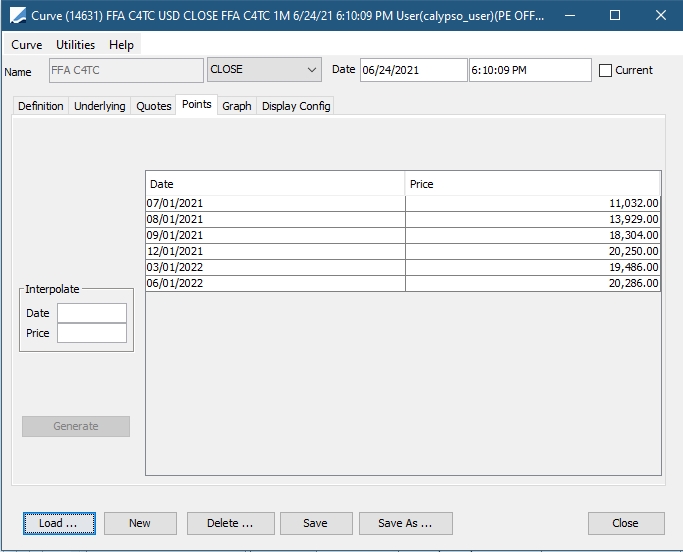

Points

For information regarding commodity curve definition, refer to Market Data Curve Commodity documentation.

For information regarding commodity curve definition, refer to Market Data Curve Commodity documentation.

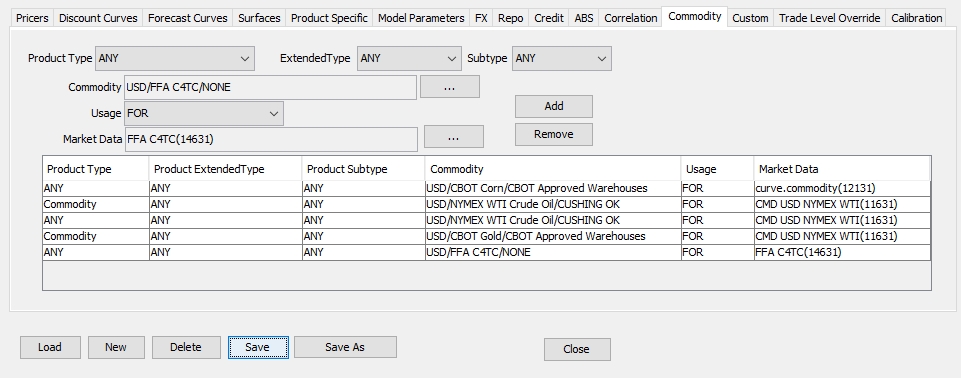

Step 7 - Register FFA C4TC Forward Curve in Pricing Environment.

Register the curve in the Pricing Configuration. (Market Data > Pricing Environment > Pricer Configuration)

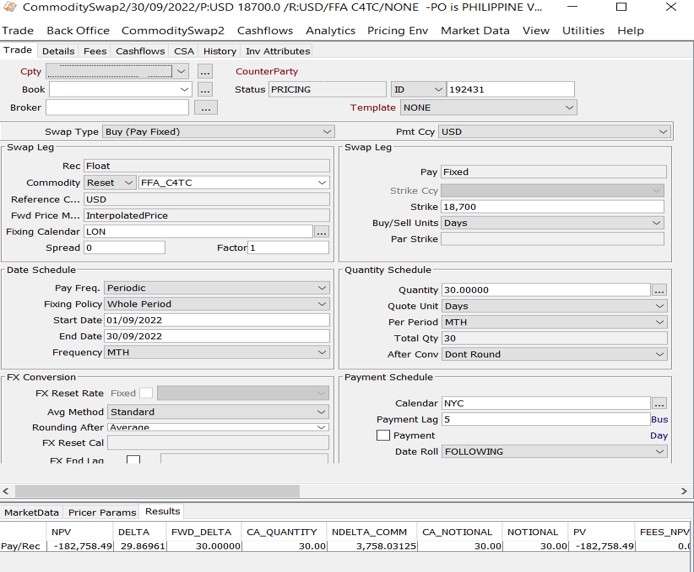

2.1 Commodity Swap Trade Example

When creating a Commodity Swap trade, when the reset rule FFA C4TC is chosen, the corresponding forward curve is automatically selected.