Rating Equivalents

The system allows configuring user-defined sets of ratings as each agency has its own rating values, and displaying those sets in the Portfolio Workstation.

Before You Begin

Ratings can be set on Bond products, Funds, and Mandates when defining the products. They can also be set on the products' issuers in the Legal Entity window.

Rating agencies are defined in the domain ratingAgency.

Rating values for each agency are defined using Configuration > System > Rating Values from the Calypso Navigator.

Rating equivalence types, or sets, are defined in the domain RatingEquivalenceType. The default set "None" is available in addition to any domain values defined here.

1. Defining Rating Equivalents

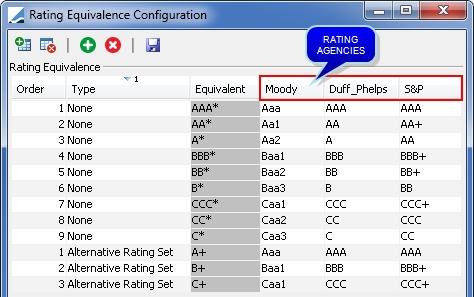

Rating Equivalents are defined using the Rating Equivalence Configuration window.

From the Calypso Navigator, navigate to Configuration > Asset Management > Rating Equivalent (menu action am.RatingEquivalenceWindow).

Step 1 – Click ![]() to add a rating agency for which you want to define rating equivalents. You will be prompted to select a rating agency.

to add a rating agency for which you want to define rating equivalents. You will be prompted to select a rating agency.

It will be added as a column.

Step 2 – Click ![]() to add a rating equivalent. It will add a row. Enter the following information:

to add a rating equivalent. It will add a row. Enter the following information:

| » | Enter the order where "1" is the best. |

| » | Select the rating type. |

| » | Enter the equivalent value. |

| » | Select the corresponding value for each rating agency. |

Repeat as needed for each equivalent.

Step 3 – Click ![]() to save the configuration.

to save the configuration.

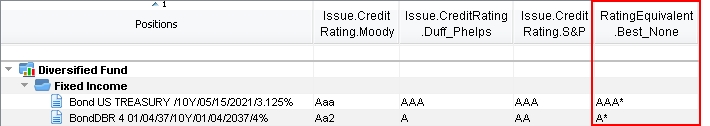

2. Displaying Rating Equivalents in the Portfolio Workstation

To display the rating equivalents in the Portfolio Workstation, you need to select the RatingEquivalent columns in the analysis that you want to run, then configure the columns in the Portfolio Workstation.

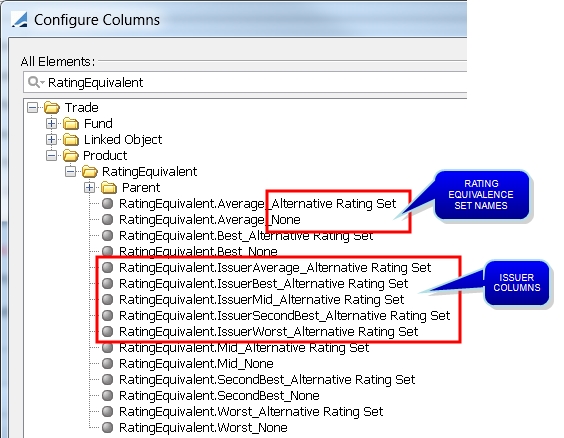

Step 1 – Select the RatingEquivalent columns.

When defining the parameters of the analysis, select the RatingEquivalent columns in the Trade Attributes.

They are located under Trade > Product > RatingEquivalent:

Each RatingEquivalent column is available for each rating equivalence set.

The "Issuer" columns correspond to the product issuer's rating, and the other columns correspond to the product's rating.

For legal entities with roles Issuer and Counterparty, the counterparty equivalent ratings are derived from the issuer rating.

For legal entities with role Counterparty only, the counterparty equivalent rating is empty.

Step 2 – Configure the columns in the Portfolio Workstation.

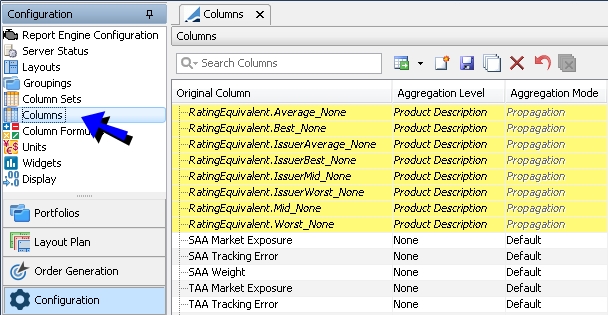

Select Configuration > Columns to configure the columns as needed.

| » | You can define the column parameters as needed. |

| » | Click |

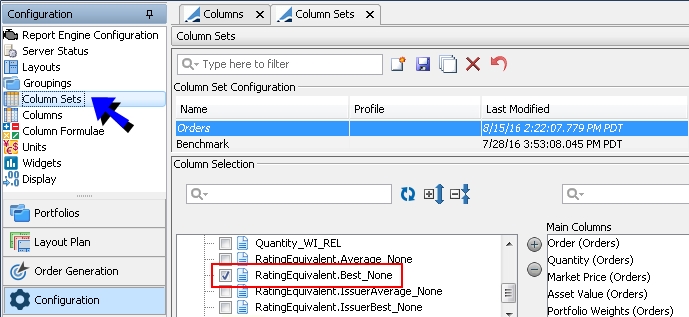

Select Configuration > Column Sets to add the columns to the display.

| » | You can use the RatingEquivalent columns as any other columns. |

| » | Click |

| » | You can also define groupings on the columns as needed. |

Step 3 – Run the analysis.

When you run the analysis, the columns are displayed according to your configuration.