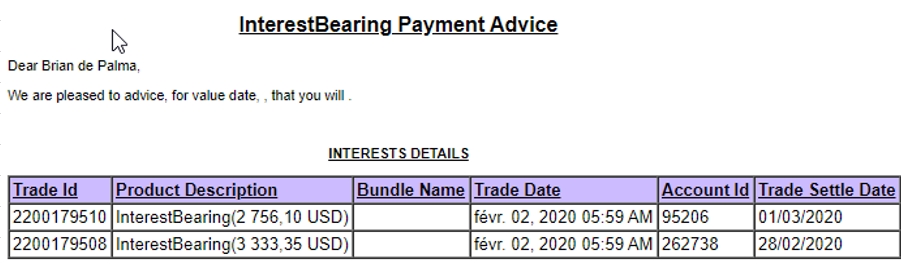

Generating Account Interests

Account interest trades (interest bearing trades) are generated by the scheduled task ACCOUNT_INTEREST based on actual cash account positions and interest bearing rules.

Account Interest Generation Flow

1. Before you Begin

1.1 Interest Bearing Rules

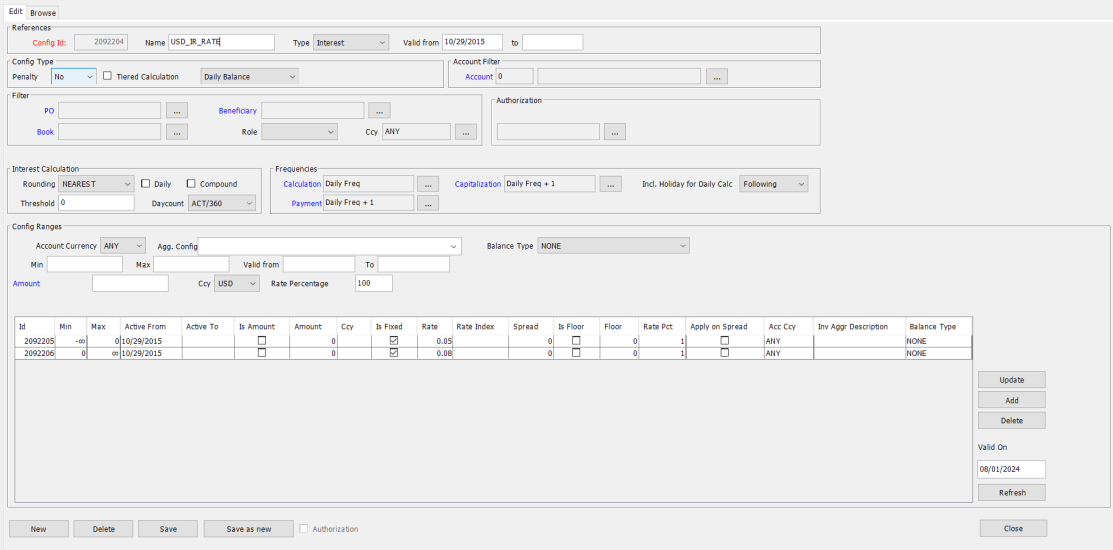

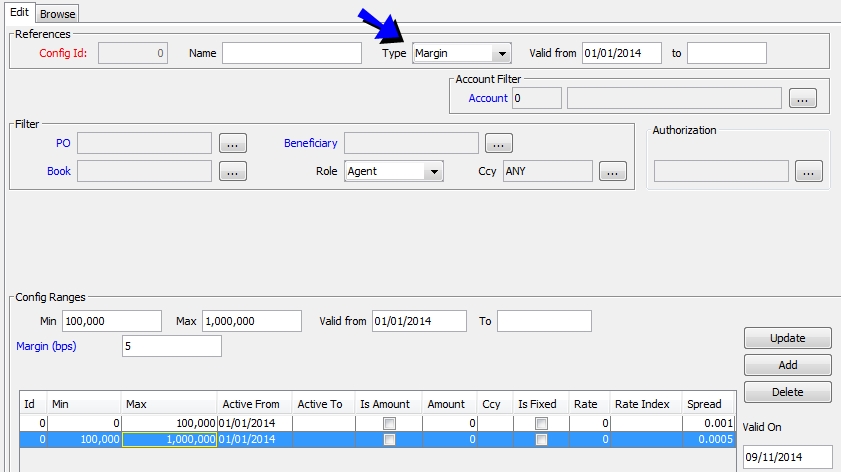

From the Calypso Navigator, navigate to Configuration > Accounting > Interests (menu action refdata.AccountInterestConfigWindow).

The Browse panel is selected by default. Select the Edit panel to define an interest bearing rule.

| » | Enter all the necessary information. The fields are described below. |

| » | To define a range, enter the parameters of the interest calculation, then click Add to add the range. Repeat for other ranges as needed. |

| » | Click Save to save the rule. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

| Fields | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Config Id |

Given by the system when the configuration is saved. |

|||||||||||||||

|

Name |

Set and name standard configurations to apply to groups of clients and/or accounts. Any changes to the configuration will automatically be applied to all clients and/or accounts linked to the configuration. |

|||||||||||||||

|

Type |

Select the type of configuration: Interest or Margin. Margin configurations only apply to call accounts.

The other types of configurations (IM, ITD, VM) apply to clearing - Please refer to Calypso Clearing documentation for details. |

|||||||||||||||

| Valid From / To |

Enter the validity dates of the configuration. |

|||||||||||||||

|

Config Type |

You can select No, Yes, or Both for Penalty. The penalty configuration is applied when the account balance is below a certain amount. Limits are defined in the Limits panel. Ⓘ [NOTE: When Processing Org attribute "ALWAYS_PAY_PENALTY_INTEREST" is False, interest penalty is not paid if an account is defined with minimum balance and balance is below the limit but positive. Default is True (interest penalty is paid)] You can check Tiered Calculation to distribute the account balance over the range. Otherwise, it is applied to the absolute range. |

|||||||||||||||

| Account Filter | You can select an account, or none to apply the configuration to all accounts. | |||||||||||||||

|

Filter |

It is possible to link an account interest config to:

|

|||||||||||||||

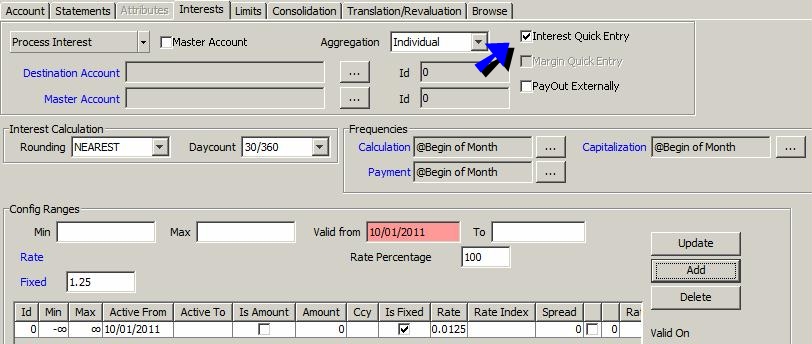

| Interest Calculation |

Select rounding information and calculation. You can check Daily to apply the rounding to each daily amount. Rounding is applied to the final interest amount otherwise. You can enter a threshold. If the account balance is below the threshold, interest will not be computed. If you check "Compound", you need to select a compound rule to compound the interest. Ⓘ [NOTE: When computing the interest, you need to select the retroactivity mode in order for the compounding to occur: Check the "retro Activity" checkbox in the Account Interest Runner, or set the attribute RETRO_ACTIVITY = True in the ACCOUNT_INTEREST scheduled task] You can select a daycount for Fixed Rate configurations (for Floating Rate configurations, the daycount of the Rate Index definition is used). Including PARTIAL_SETTLE entries to Position To add PARTIAL_SETTLE entries amount in interest calculation, you can set Account Property 'Add PARTIAL_SETTLE to position' to true. |

|||||||||||||||

|

Frequencies |

Select the calculation frequency, payment frequency, capitalization frequency and Incl. Holiday for Daily Calc frequency (for Daily settlement of Interest). When the calculation date is at the end of the month, the interest is calculated until the last day of the month, regardless of which day it is. If the last day of the month is a Saturday, and you want to calculate the interest until Sunday (or until the end of a holiday), you need to set the account property CHECK_END_OF_MONTH = false (it is true by default). Settle Date Generation Issue for Date Rule with Relative Month There are two ways to use a date rule in Interest Bearing trades: next(date) provides the next date generated by the date rule and generate(fromDate, toDate) provides all the dates generated by the date rule between the from and to dates. The “generate” method is used by default for all date rules as it has a better performance. The “next” method is used for DAILY and RELATIVE using DAILY date rules. You can use the “next” method for any date rule as needed by adding the date rule to the domain "dateRuleInterestUseNext". Daily Settlement of Interest For daily settlement of Interest Bearing trades, weekend accruals are included on Interest Bearing trades based on “Incl. Holiday for Daily Calc”: - Following: Weekend Accruals are included in the Interest Bearing trade settling on the previous business day - Preceding: Weekend Accruals are included in the Interest Bearing trade settling on the next business day - BLANKS: Weekend Accruals are included in the Interest Bearing trade settling on the previous business day (Default) |

|||||||||||||||

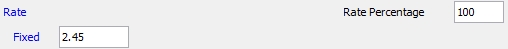

| Config Ranges |

Select the account currency, inventory aggregation, and the balance type as needed. Enter the minimum amount / maximum amount as needed to define the ranges. Enter Active From / Active To date for the configuration. When the Active To date of the configuration is in the past, you can set account property SKIP_INTEREST_BEARING = true to stop computing interest bearing for that account. You can double-click the Amount label to switch to Rate instead, in which case you can specify a fixed rate or a floating rate. Select the interest currency. Amount

Fixed Rate

Floating Rate

You can enter a spread in the field next to the currency. You can define a floor rate (minimum rate). Note that if you allow negative rates, you should either set a negative floor rate ("-1.2" for example), or no floor rate. Negative Rates If you set the pricing parameter ALLOW_NEGATIVERATE to true for the InterestBearing product type, the system allows calculating interest with negative rates. You can set the starting date to consider negative rates in the pricing parameter ALLOW_NEGATIVERATE_DATE (provided ALLOW_NEGATIVERATE = true). The format should be MM-DD-yyyy. However, if the account attribute "NEVER USE NEGATIVE RATE” is set to true for a given account, the system will not allow calculating interest with negative rates even if ALLOW_NEGATIVERATE is true. Zero Interest If you set the pricing parameter EXCLUDE_ZERO_TRADE to true for the InterestBearing product type, the system does not generate trades with zero interest. They are generated otherwise. Reset Rate You can determine how the reset rate is used throughout the reset period using the value IB_USE_RESET_DAY_FOR_DATE_RULE in the domain “AccountSetup”. If Comment = true, the reset rate is used for the whole reset period. It is only used for the reset date otherwise. You can determine how missing rates are handled based on the value of account attribute IB_MISSING_RATE:

|

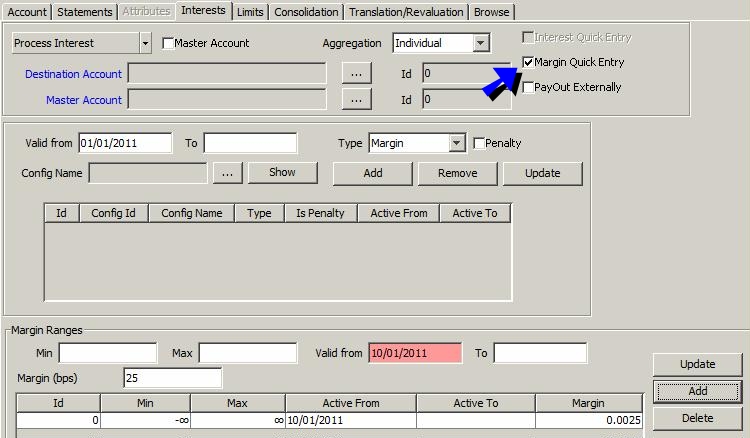

For call accounts, you have the ability to add a specific Margin (in bps) onto an account (not visible by the client):

| • | The margin is added on top of the interest configuration set on the Account. |

| • | It can be entered as a pre-configured margin and the line can be added to the Interest list configuration, or can be add as a Quick Entry Margin. |

| • | A margin can only be entered if an account has a generic Interest Config (not a quick entry). |

| • | It cannot be inherited from a Master Account (only the Interest configuration can be). |

| » | Define the characteristics of the margin calculation and click Add. |

| » | Then click Save to save the configuration. |

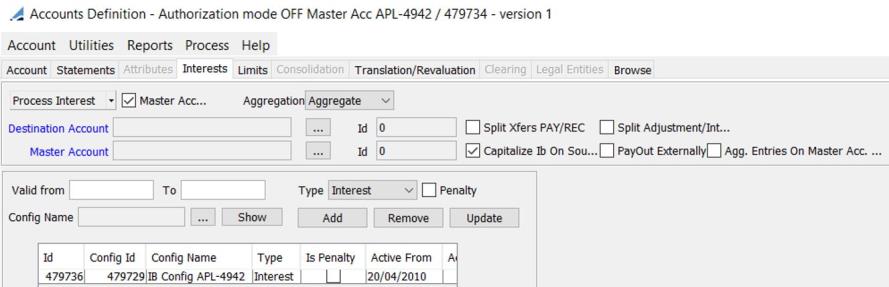

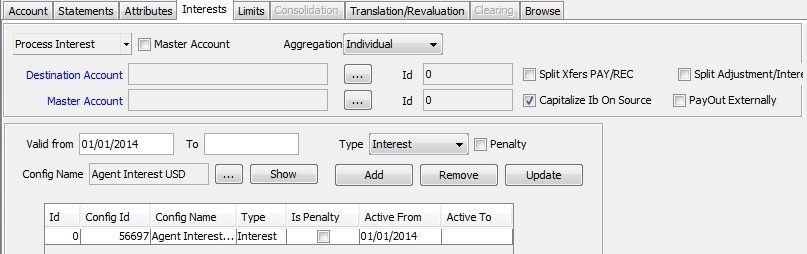

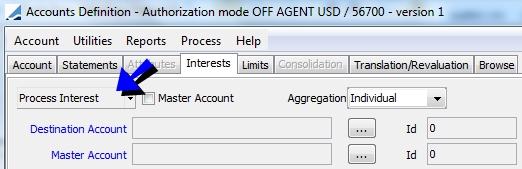

1.2 Associating an Interest Bearing Rule with an Account

Once you have defined a rule, you need to associate it with the account that is receiving interest.

From the Calypso Navigator, navigate to Configuration > Accounting > Accounts, and load your account in the Account panel.

| » | Check the Interest Bearing checkbox - Once checked, the Interests panel becomes available. |

Note that for call accounts, "Interest Bearing" is mandatory and checked by default.

If the interest bearing rule has a capitalization frequency, the interest is capitalized, and any adjustment due to back-dated trades is capitalized as well. If you do not want to capitalize the adjustments, you can set the account attribute "CAPITALIZE ADJUSTMENTS" to false.

| » | Then select the Interests panel. The interest rule can be defined for individual accounts or for master accounts. See below for details. |

| » | You can also associate an interest rule with multiple accounts using Process > Interest Bearing > Bulk Update Interest Config. |

Note that this function is only available for call accounts.

It brings up the Account report: Load the call accounts that you want to update and select them. Right-click and choose Action > Update Current Interest Config. You will be prompted to select an interest / margin configuration.

Click Apply to set the selected configuration on the selected accounts.

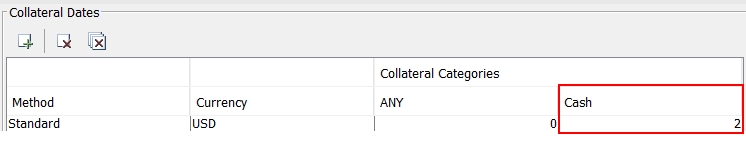

The account can be associated with a Margin Call Contract using the account attribute MC_CONTRACT_ID.

In this case, you can use the trade workflow rule UpdateIBSettleDate to automatically set the Settle Date Confirmed field on the Interest Bearing trade. It shows the trade keyword ConfirmedSettleDate = Date action is applied + OffSet Days from associated Margin Call Contract (Cash column of the Collateral Dates in the Dates & Times tab).

If the account of the Interest Bearing trade is not associated with a Margin Call Contract or the Offset Days are not set, ConfirmedSettleDate = Settlement Date.

The Settle Date Confirmed can also be set manually on the Interest Bearing trade.

When set, this date is used as the settlement date in the associated transfers.

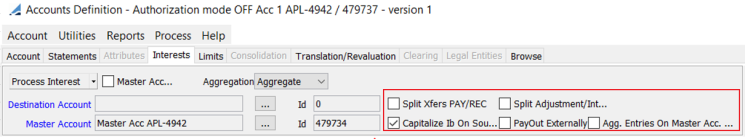

Master Account Setup

For the master account, check the Master Account checkbox.

| » | Set the Aggregation to Individual to apply the interest rule to the master account’s balance only, or Aggregate to apply the interest rule to the balance of all the accounts within the master account including the master account. |

| » | Optional - Select the account where the interest will be posted from the Destination Account field (if different from the account itself). |

| » | Define a validity period. |

| » | Select the type of configuration: Interest or Margin (Margin configurations only apply to call accounts). Then click ... next to the Config Name field to select an interest rule. If the interest rule is specific to a processing organization, beneficiary, or account, it will only be available on the corresponding account. |

So for example if the interest rule is specific to agent MYAGENT, you will only be able to associate this rule with an account for legal entity MYAGENT and role Agent.

You can set additional parameters: "Split Xfers PAY/REC", "Split Adjustment/Interest", "Capitalizes Ib On Source", "PayOut Externally", "Agg. Entries On Master Account".

See Additional Settings for details.

See Additional Settings for details.

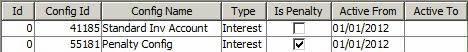

If the interest rule is defined as both interest and penalty, an interest will be computed when the balance on the account is above its overdraft limit or minimum balance requirement, and a penalty will be computed otherwise.

Limits are defined in the Limits panel.

If the interest rule is defined as interest only (Penalty = No), an interest will be computed when the balance on the account is above its overdraft limit or minimum balance requirement. In this case, you can also associate a penalty configuration if you have defined one. Check the Penalty checkbox, and add a penalty configuration to the account.

| » | Click Add to add the rule. Then click Save. |

To associate and account with a master account, clear the Master Account checkbox, and select the master account. Select the account where the interest will be posted from the Destination Account field (if different from the account itself).

There is no need to select an interest rule – The interest rule of the master account will be applied.

| » | Set the Aggregation to Individual to apply the interest rule to the individual account’s balance only, Master to apply the interest rule to the master account’s balance only, or Aggregate to apply the interest rule to the balance of all the accounts associated with selected the master account including the master account. |

| » | Click Save. |

Individual Account Setup

Same as for a master account but the Master Account checkbox is unchecked, and the Master Account field is empty. The only available aggregation level is Individual.

| » | Optional - Select the account where the interest will be posted from the Destination Account field (if different from the account itself). |

| » | Define a validity period then add an interest rule as described in the Master Account Setup. |

| » | Click Add to add the rule. Then click Save. |

Additional settings can be set for generating account interest.

| • | You can check "Split Xfers PAY/REC" to create two transfers for a given Interest Bearing trade: one that aggregates the PAY entries, and one that aggregates the REC entries. Otherwise all entries are aggregated into a single transfer. |

| • | “Split Adjustment/Interest” - When not checked, only Interest Bearing trades of type INTEREST are generated. When checked, Interest Bearing trades of type INTEREST are generated for credit balances, and Interest Bearing trades of type ADJUSTMENT are generated for debit balances. |

| • | You can check "Capitalizes Ib On Source" to create the interest bearing trade on the source account - The account can be transferred to an external account using the scheduled task ACC_TRANSFER_INTEREST. It can be transferred to: |

| – | The destination account if specified. |

| – | The account associated with the external counterparty if "PayOut Externally" is checked. The external counterparty is selected in the attributes of the scheduled task ACC_TRANSFER_INTEREST. |

The transfer of interest is triggered by the scheduled task ACC_TRANSFER_INTEREST, or manually at the account level when you choose Process Interest > Pay Interest.

See Transferring Interest for details.

See Transferring Interest for details.

If "Capitalizes Ib On Source" is not checked, the interest bearing trade is created directly on the external account:

| – | The destination account if specified. |

| – | The account associated with the legal entity of the source account for role CounterParty if "PayOut Externally" is checked. |

For example, the source account is defined for legal entity AGENT1 with role Agent. If "PayOut Externally" is checked, the system will look for an account defined for legal entity AGENT1 with role CounterParty.

| • | You can check "PayOut Externally" to transfer the interest to an external counterparty - See "Capitalizes Ib On Source" for details. |

| • | You can check "Agg. Entries On Master Account" to aggregate all entries from Master and Child accounts into a unique Interest Bearing trade on the Master account. This is only applicable if the field Aggregation = Aggregate. |

Call Accounts

When you associate an interest bearing rule with a call account, additional functions are available.

You can check "Interest Quick Entry" to define the interest configuration on-the-fly.

| » | Define the characteristics of the interest calculation and click Add. |

| » | When you save the account, the interest configuration is saved as well. |

You can check "Margin Quick Entry" to define the margin configuration on-the-fly.

| » | Define the characteristics of the margin calculation and click Add. |

| » | When you save the account, the interest configuration is saved as well. |

1.3 Access Permission and Authorization

The access permissions relating to account interest generation are: AddModifyAccountInterest and RemoveAccountInterest.

In order for Authorization mode to apply to account interest configs, you need to add “AccountInterestConfig” to the domain “classAuthMode”.

2. Generating Account Interest

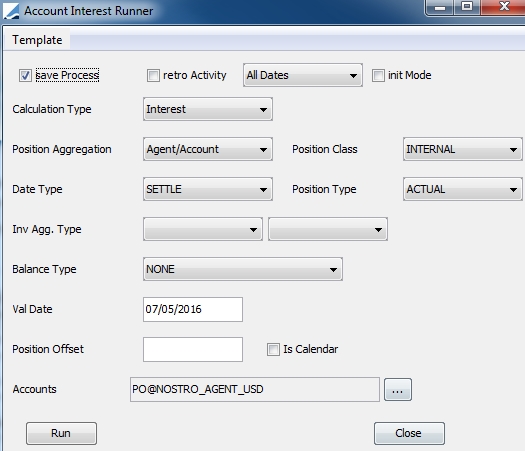

You can process interest computation from the Interests panel in the Accounts window by clicking the Process Interest button, or you can run the ACCOUNT_INTEREST scheduled task.

2.1 Process Interest on the Fly

| » | When you click Process Interest, the Account Interest Runner dialog appears. |

Check “save Process” to generate the interest bearing trades, select the proper position criteria, and click Run.

You can save the information as a template.

For information on "retro Activity" and "init Mode", please refer to the ACCOUNT_INTEREST scheduled task below.

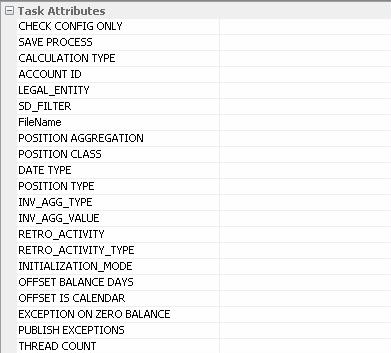

2.2 ACCOUNT_INTEREST Scheduled Task

From the Calypso Navigator, navigate to Configuration > Scheduled Tasks (menu action scheduling.ScheduledTaskListWindow), and configure a task of type ACCOUNT_INTEREST.

Interest bearing trades are generated based on the inventory position computed by the Inventory engine on accounts associated with an interest bearing rule.

Select a trade filter, a user, a pricing environment, and a processing organization.

In the scheduled task, you can specify the agent for which you want to generate account interest, and the inventory position to select.

Set the following attributes as needed.

| • | CHECK CONFIG ONLY - Set to true to check that all the selected accounts have a valid config from the valDate to the valDate + “To Days” (default is 1 month). The expired config is displayed in the file given as attribute. This produces a report which lists all the interest matrices that are attached to live accounts and that have expired or are due to expire in the coming month (or number of days defined in the "To Days" of the Scheduled Task). If attribute set to false, ACCOUNT_INTEREST exceptions will be generated instead. |

| • | SAVE PROCESS - If False, the scheduled task will simulate the Interest bearing process and generate a report to be checked by the users. If True, it will also save the Interest Bearing Trade. |

| • | CALCULATION TYPE - Refer to the type defined on the matrix; choose Interest, Claim, etc. Interest in this example. |

| • | ACCOUNT ID - You can enter one particular account if you want to launch the process on one specific account only. |

| • | LEGAL_ENTITY - You can enter one particular Client name if you want to launch the process for one particular Client only. |

| • | SD FILTER - Define an SD Filter if you want to restrict the process to one given Processing Organization or Book. |

| • | FileName - Set the name and the directory of the report displaying the interest trades. |

| • | POSITION AGGREGATION - Define the type of position aggregation that will be used as the basis of interest calculation: “Agent/Account” or “Book/Agent/Account”. |

| • | POSITION CLASS - Client: To calculate interest on client accounts, Internal: To calculate interest on nostro accounts, or External: To calculate interest on incoming positions for reconciliation purposes. |

| • | DATE TYPE - Trade: To calculate interest based on trade date positions, Settle: To calculate interest based on settle date positions (real settle date), or Value: To calculate interest based on value date (theoretical settle date) => this Would be the most commonly used for interest calculations. |

| • | POSITION TYPE - Actual: For interest calculations, Theoretical: Should not be used (it is available for flexibility purposes in case one client wants to use it), or Failed: For claim calculation. |

| • | INV_AGG_TYPE - Select an inventory aggregation type as applicable. |

| • | INV_AGG_VALUE - Select an inventory aggregation value as applicable, or “_ANY_”. |

| • | RETRO_ACTIVITY - True: The process will work in retro-activity mode, or False: The process will not apply any retro-activity rules. |

In retro-activity mode, the system generates adjustments for backdated movements (if any) between their value date and their real settle date. To manage the adjustments, the system creates a new position ACTUAL in value date.

Note that the retro-activity mode is required to compute interest compounding.

| • | RETRO_ACTIVITY_TYPE - Used in case the retro-activity is set - The default is "All Dates": We use one year in the past or retro-activity date rule set on the account. |

You can also select:

| – | Current month : Since the beginning of the month. |

| – | Previous month: Since the beginning of the previous month. |

| – | Current year: Since the beginning of the year. |

| – | Previous year : Since the beginning of the previous year. |

| • | INITIALIZATION MODE - Set to True: Normally you set this the first time you calculate interest in the system. This will allow the system to create trades of interest without generating adjustments. |

| • | OFFSET BALANCE DAYS - By default, the interest is calculated on the balance on the valuation date - You can enter a number of days to calculate the interest on the balance on the valuation date minus the number of days. |

| • | OFFSET IS CALENDAR - To specify if the offset of the balance is calendar or business days. |

| • | EXCEPTION ON ZERO BALANCE - When there is an error due to a missing configuration, by default we publish an exception only when the balance is not zero. You can set this attribute to true to generate an exception on zero balances as well. |

| • | PUBLISH EXCEPTIONS - If set to false, we do not create a task when there is an error of configuration / missing quote. You can set to true to create a task in such a case. |

| • | THREAD COUNT - Enter the number of threads for multi-thread processing by account. Default is 1 (no multi-thread processing). |

Once the scheduled task is defined, save it and run it.

Ⓘ [NOTE: It is recommended to run the process with the Inventory engine off]

The scheduled task retrieves all SETTLE accounts with the “Interest Bearing” checkbox checked, and the positions corresponding to the selected attributes.

The position is stored each day and retrieves the corresponding interest bearing rule to compute the interest amount. The scheduled task creates interest bearing trades.

Book Selection

If environment property IB_USE_BOOK_POSITION = true (default), the book associated with the cash position, if any, is selected.

Otherwise:

| • | The book specified in the account attribute "FUNDING BOOK" is selected in priority. |

| • | If not set, the book specified in the legal entity attribute "FUNDING BOOK" of the account's processing org is selected. |

| • | If no book is associated with the cash position, the User Defaults book of the user generating the trades is selected. |

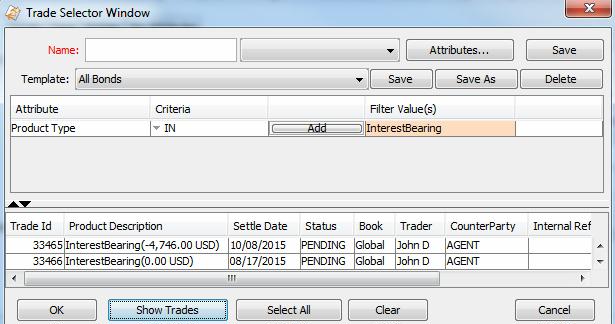

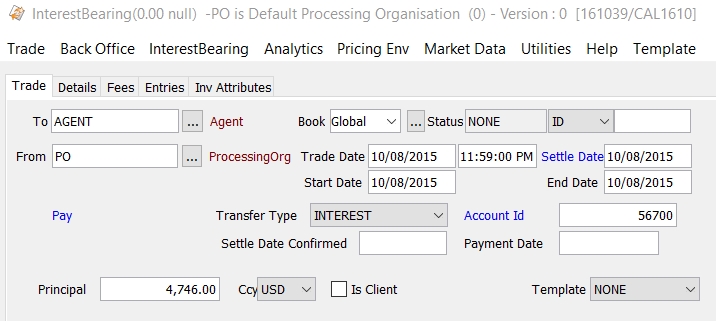

Viewing Interest Bearing Trades

From the Calypso Navigator, navigate to Processing > Accounting Operations > Interest Bearing > Trade > Open to view the interest bearing trades.

It opens the trade selector.

| » | Click Show Trades to view all interest bearing trades. |

| » | Double-click a trade to view its details. |

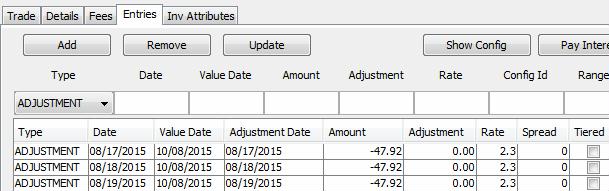

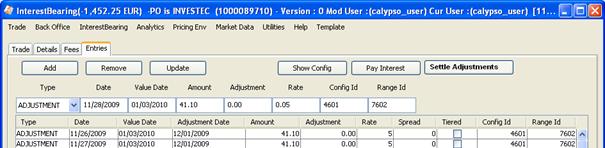

You can select the Entries panel to view the calculation details.

You can click Pay Interest to transfer the interest to another account.

See Transferring Interest for details.

See Transferring Interest for details.

Ⓘ [NOTE: To view interest bearing trades in the Trade Browser, you need to add 1 day to the valuation date because the trades are created as of today at 11:59:00 PM]

2.3 Interest Bearing Trades Pricing

Agent Accounts

Pricer measures are shown from the perspective of the Processing Org: positive when the PO receives interest from the Agent, and negative when the PO pays interest to the agent.

Client Accounts

Pricer measures are shown based on the environment property PO_VIEW_OF_CLIENT_IB.

If PO_VIEW_OF_CLIENT_IB = false (default), pricer measures are shown from the perspective of the Client: positive when the Client receives interest from the PO and negative when the Client pays interest to the PO.

If PO_VIEW_OF_CLIENT_IB = true, pricer measures are shown from the perspective of the Processing Org: positive when the Client pays interest to the PO and negative when the PO receives interest from the PO.

3. Transferring Interest

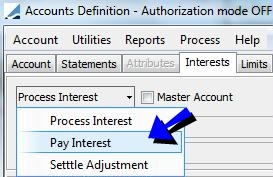

You can transfer the interest to another account by choosing Process Interest > Pay Interest in

the Interests panel of the Account window, or navigate to Configuration > Scheduled Tasks (menu action scheduling.ScheduledTaskListWindow), and configure a task of type ACC_TRANSFER_INTEREST. It

will generate a customer transfer.

If you set the transfer workflow rule ApplyActionLinkedXfer on the transitions VERIFIED – SETTLE – SETTLED and SETTLED – UNSETTLE – VERIFIED, both the interest payment and the interest transfer will be settled at the same time.

Only positive interest amounts are transferred by default but the account can be setup to also receive interest by setting the account attribute "PayInterestOnly=False".

The following trade keywords are populated:

| • | INTEREST_TRANSFER_FROM (on Customer Transfer trades) |

| • | INTEREST_TRANSFER_TO (on Interest Bearing trades) |

| • | TradeSource (on Customer Transfer trades) |

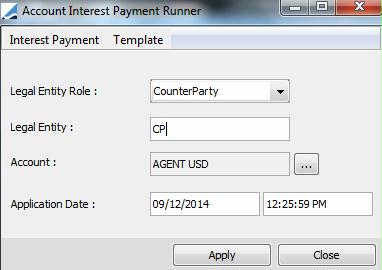

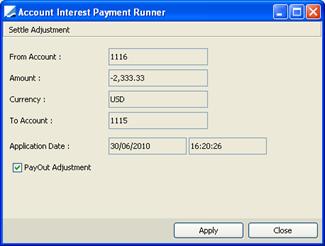

3.1 Pay Interest On-the-fly

When you select Process Interest > Pay Interest, it brings up the Account Interest Payment Runner dialog.

| » | Select the destination legal entity role and legal entity. This will determine the SDIs to be used, and therefore the destination account. |

| » | Select the source account. |

| » | Enter an application date and click Apply. |

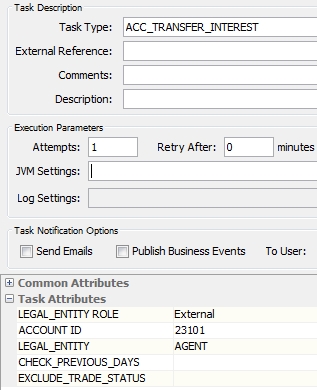

3.2 ACC_TRANSFER_INTEREST Scheduled Task

Select a trade filter, a user, a pricing environment, and a processing organization.

| » | Set the following attributes: |

| – | LEGAL_ENTITY ROLE – Role of the legal entity to which the interest is transferred. In order to choose the correct SDI, you must assign a new role to the legal entity (External for example). So this legal entity will have a SDI for the role Agent and a SDI for the role External (which will contain the external account). |

| – | ACCOUNT_ID - Id given by the system, not the account name. Source account. |

| – | LEGAL_ENTITY - Name of the Legal Entity to which the interest is transferred. |

| – | CHECK_PREVIOUS_DAYS - When set to true and the valuation date is not the payment date, the system amends /creates the interest bearing trade if the payment date is a holiday. When set to false, the interest bearing trade is amended / created only if the valuation date is the payment date. |

| – | EXCLUDE_TRADE_STATUS - You can enter a list of comma-separated status codes to exclude the trades in corresponding status. |

| » | Once the scheduled task is defined, save it and run it. |

4. Withholding Tax

To activate the Withholding Tax in Calypso, set the environment property WITHHOLDINGTAX to true.

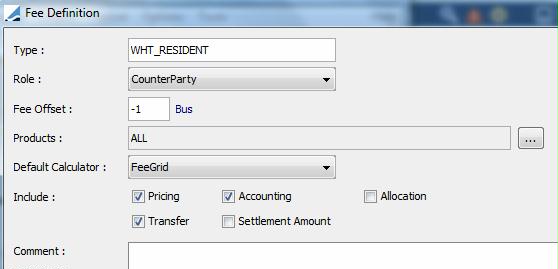

From the Calypso Navigator, navigate to Configuration > Fees, Haircuts, & Margin Calls > Fee Definition to define the withholding tax fees. You can define as many fees as needed (a resident WHT fee, a non resident WHT fee, and an XTRA WHT fee to handle the cases where no DTT treaty is signed).

| » | You can click Help for complete setup details. |

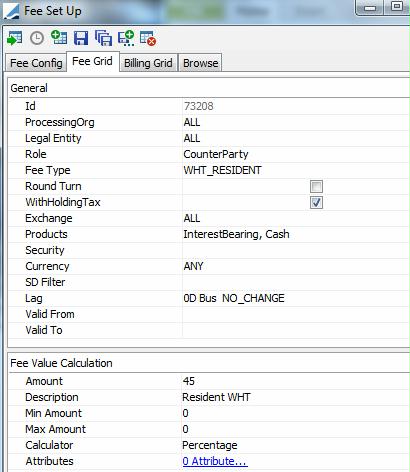

Then from the Calypso Navigator, navigate to Configuration > Fees, Haircuts, & Margin Calls > Fee Set Up to define the related grids in the Fee Grid panel. Be sure the grid is flagged as WithholdingTax and defined with Role = ALL. Thus the grid may be eligible for both Loan and Deposit trades (where client role is counterparty), and Interest Bearing trades (where client role is the Account Holder role).

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

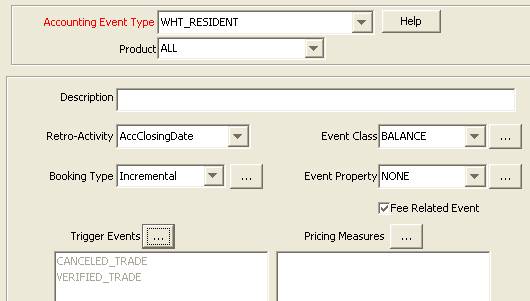

Then define the related accounting events.

From the Calypso Navigator, navigate to Configuration > Accounting > Events and define an event with event name equals to the fee type:

Make sure to check "Fee Related Event".

Withholding Tax transfers are created by the Scheduled Task ACCOUNT_INTEREST.

As soon as Withholding Tax applies to an Interest Bearing Trade, the system generates an additional transfer type <WITHHOLDINGTAX FeeName>. In terms of messages, the WITHHOLDINGTAX related transfer should move to SETTLED when the related INTEREST transfer is moved to SETTLED. Then it impacts:

| • | The account balance and is taken into account into the Asset/Liability and Reclassification Accounting process |

| • | The account statement |

5. Rate Change

Rate Change is currently only supported on call accounts.

5.1 RATE_CHANGE Transfer

To be able to report rate changes in customer statements, the system creates a transfer of type "RATE_CHANGE", attached to the interest bearing trade(s), based on its value date. If needed, please add it to the domain "flowType".

RATE_CHANGE transfers are created by the scheduled task ACCOUNT_INTEREST.

The system creates a RATE_CHANGE transfer type with a specific Xfer Description as stated below.

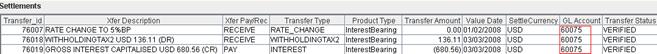

Example 1: INTEREST and withholding tax

Example 2: INTEREST without withholding tax

![]()

The new rate is used in interest calculation (new adjustment) from its value date.

A RATE_CHANGE transfer can also be generated by the system if the floating rate index used in the configuration is changing in the Quote Set. This Rate Index has to be defined as a Base Rate and its attribute GenerateRateChange must be set to True.

Ⓘ [NOTE: It must only be used in case of an annually or monthly reviewed rate (i.e. Base Rate or equivalent) in order not to produce a daily RATE_CHANGE]

By default, a RATE_CHANGE transfer is generated for Interest Bearing Trades with zero amount.

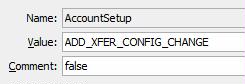

If you do not want to generate those transfers, you can set the Comment to "false" in the domain “AccountSetup” for the value "ADD_XFER_CONFIG_CHANGE".

5.2 Backdated Rate Change

Back dated RATE_CHANGE transfers are also created by the scheduled task ACCOUNT_INTEREST, provided the RETROACTIVITY attribute is set to True.

In such a case, the system creates a RATE_CHANGE transfer with Value Date = Initial Date of Rate Change and Settle Date = Today (entered date of the rate change), provided you have set the property XFER_BV_REAL_SETTLE_DATE to true.

That RATE_CHANGE transfer is attached to the Interest Bearing trade of the initial period where it should have been confirmed and will be reported on the current period statement, based on its SETTLE DATE, provided it is in a SETTLED status.

5.3 Rate Change Message

When generating a RATE_CHANGE transfer (on the current Interest Bearing trade), two Xfer Attributes are populated:

| • | RateChangeName: set to "FixedRate" or to the name of the floating rate +(spread+margin) |

| • | RateChangeValue: All In rate at the related value date |

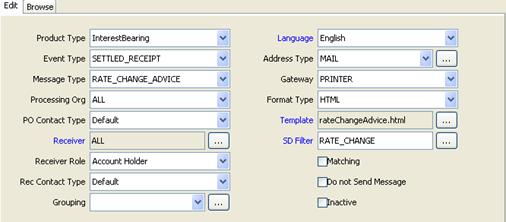

This transfer can trigger a message based on message type "RATE_CHANGE_ADVICE".

Sample message setup:

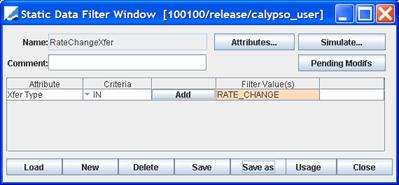

The Static Data Filter RATE_CHANGE filters on the Xfer Type = RATE_CHANGE.

The following template keywords can be used:

| • | |TRANSFER_VALUEDATE| is the date at which the rate is changing |

| • | |TRANSFER_SETTLEMENTCCY| is the currency of the customer account |

| • | |CALL_ACCOUNT_TYPE| |

| • | |CALL_ACCOUNT_SUBTYPE| |

| • | |ACCOUNT_NAME| |

| • | |ACCOUNT_ACTUALBALANCE| |

| • | |TRANSFER_RateChangeValue| |

| • | |TRANSFER_RateChangeName| |

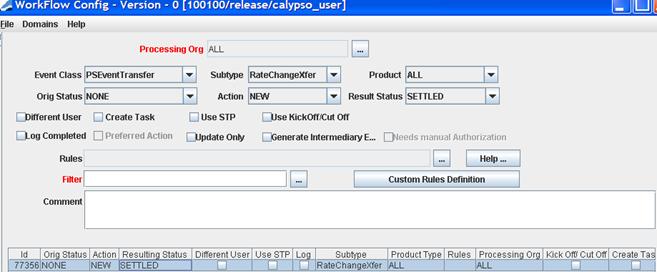

5.4 Rate Change Workflow

The RATE_CHANGE transfer should have its own workflow to go directly to SETTLED and be part of the statement for that period without creating any specific task in the Task Station.

This transfer being created for "technical reasons", the end-user should not see that transfer into their task station, and it should SETTLE automatically to make it appear as soon as created in the statements. For that reason, we advise to add the following transfer workflow subtype for RATE_CHANGE transfers

First, define the following SD Filter:

Then, add the value RateChangeXfer to the domain "XferWorkflowType".

![]()

Then from the Calypso Navigator, navigate to Configuration > Workflow > Workflow, and add the following transfer workflow for the Subtype RateChangeXfer:

RATE_CHANGE transfers will automatically go to a SETTLED status and will be reversed and NEW (using the Transfer Engine param XFER_USE_REVERSE = true).

Ⓘ [NOTE: If you want to generate a Rate Change message, then the RATE_CHANGE workflow must have a temporary status like VERIFIED to only reach the SETTLED status on value date (with a KickOff config) to avoid the multi-generation of a message in case of floating rate]

6. Settlement of Interest Bearing Adjustments

The early settlement of Interest Bearing trades can be done at Interest Bearing trade level or at the Account level as shown bellow. It creates a Transfer on current Interest Bearing trade of the account with today's date and with an amount equal to the sum of all adjustment entries initially planned at Interest Bearing Settle date.

Click Settle Adjustments - It brings up the Account Interest Payment Runner dialog.

You can also choose Process Interest > Settle Adjustment from the Interests panel of the Account window.

The window used to generate this transfer has also an additional checkbox "PayOut Adjustment" enabled if the interest must be transferred to another account. If checked, it creates the related transfer to transfer the interest which includes the calculated adjustment and related withholding tax.

Additionally, the accounting event ADJUSTMENT can be used to take into account any ADJUSTMENT amount early settled between start and end date of the Interest Bearing trade.

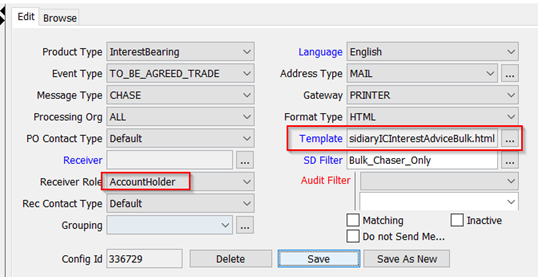

7. Chasing Interest Bearing Trades in Bulk

You can send chasers in bulk for interest bearing trades using an action with workflow rule IBBulkChaser and message template “SubsidiaryICInterestAdviceBulk.html” (based on message keyword TRADE_BROWSER_TEMPLATE that displays a Trade Browser report for the template defined in domain “BulkIBChaserTemplate”).

Domain BulkIBChaserTemplate

It must contain a Trade Browser template that contains the Interest Bearing trades for which you want to generate a chaser.

InterestBearing Trade Workflow

Add action BULK_CHASE with trade workflow rule IBBulkChaser.

Example: VERIFIED - BULK_ACTION - TO_BE_AGREED

The workflow rule prevents the generation of the bulk message if:

| • | A Trade Browser template is not defined in domain "BulkIBChaserTemplate" |

| • | No Interest Bearing trade is returned by the template |

The action should be applied to a single Interest Bearing trade, and it will generate a chaser for all trades returned by the specified template.

It is recommended to add the action BULK_CHASE to the domain "TradeActionNotAuthorizedInMultiSelection" so that you can only apply it to 1 trade, otherwise you may generate duplicate chaser messages.

Chaser Message Setup

Product Type = InterestBearing

Event Type = <result status of BULK_ACTION>_TRADE - Example: TO_BE_AGREED_TRADE

Message Type = CHASE

Template = SubsidiaryICInterestAdviceBulk.html

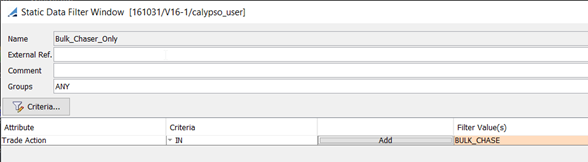

Static data filter:

When you apply the action BULK_CHASE to an interest bearing trade, the chaser is generated.